Jared Ortaliza,

Krutika Amin, and

Cynthia Cox

Published: Jun 01, 2022 - KFF

The Medical Loss Ratio (MLR) provision of the Affordable Care Act (ACA) limits the amount of premium income that insurers can keep for administration, marketing, and profits. Insurers that fail to meet the applicable MLR threshold are required to pay back excess profits or margins in the form of rebates to their enrollees.

In the individual and small group markets, insurers must spend at least 80% of their premium income on health care claims and quality improvement efforts, leaving the remaining 20% for administration, marketing expenses, and profit. The MLR threshold is higher for large group insurers, which must spend at least 85% of their premium income on health care claims. MLR rebates are based on a 3-year average, meaning that rebates issued in 2022 will be calculated using insurers’ financial data in 2019, 2020, and 2021, and will go to people and businesses who bought health coverage in 2021.

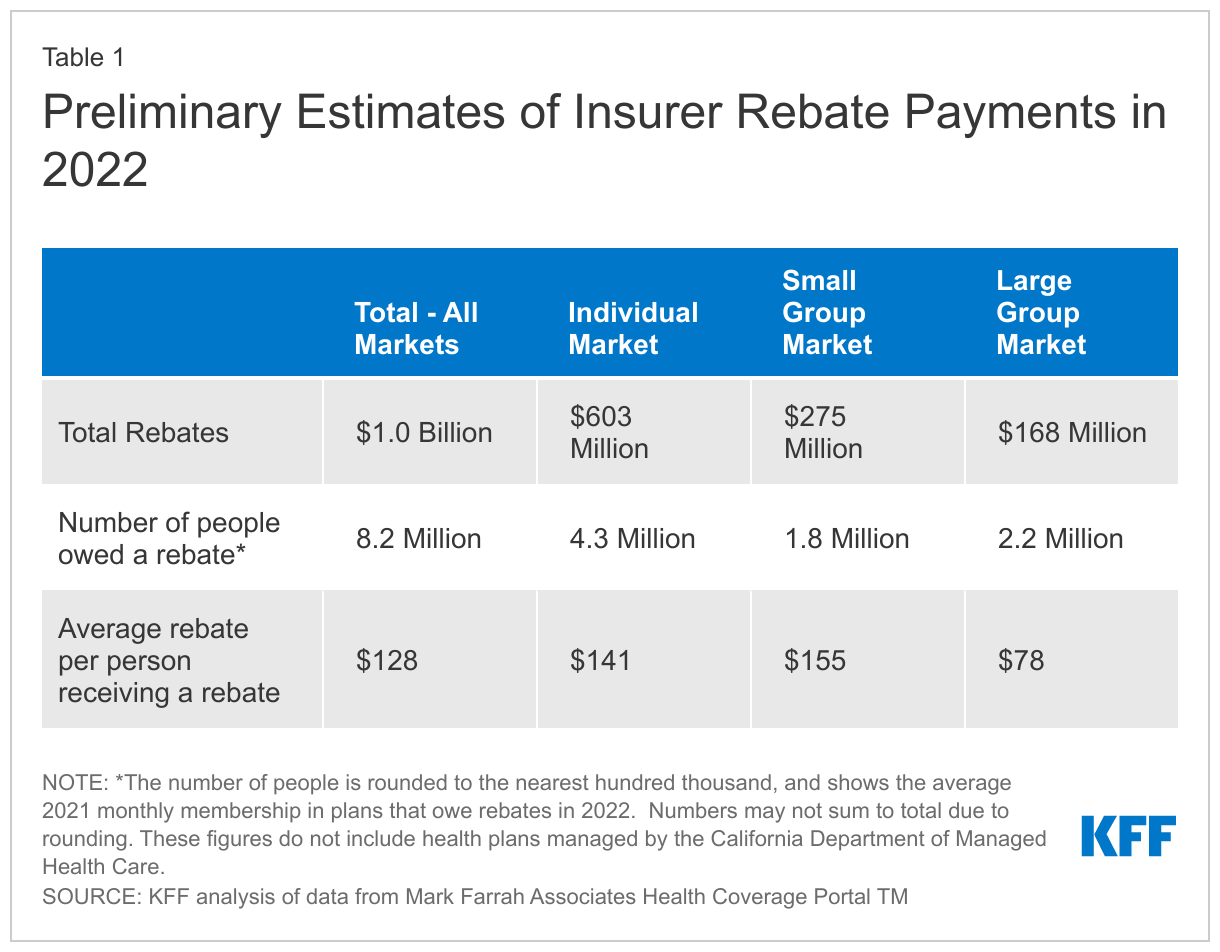

We find that insurers estimate they will issue a total of about $1 billion in MLR rebates across all commercial markets in 2022, using preliminary data reported by insurers to state regulators and compiled by Mark Farrah Associates. Final rebate data will be available later this year. Some insurers have not yet filed their 2022 rebate estimates.

Expected rebate amounts vary by market segment, with the majority going to individual market enrollees, including ACA Marketplace enrollees. Insurers in the individual market estimate they will issue $603 million in rebates, small group market insurers will issue $275 million in rebates, and large group market insurers will issue $168 million in rebates later this year.

Based on these estimates, it appears rebates issued later this year will be larger than those issued in most prior years. However, this year’s rebates fall far short of recent record-high rebate totals of $2.5 billion issued in 2020 and $2.0 billion issued in 2021. In most years, changes in the rebate totals have been driven primarily by fluctuations in the individual market. Rebates in the small group and large group market are generally smaller and more consistent over time.

Individual market insurers in 2021 had higher loss ratios and were therefore likely less profitable, on average, than they had been in recent years. The average individual market loss ratio (without adjusting for quality improvement expenses or taxes) was 88%, meaning these insurers spent out an average of 88% of their premium income in the form of health claims in 2021. However, rebates issued in 2022 are based on a 3-year average of insurers’ experience in 2021, 2020, and 2019. Some insurers experiencing relatively high loss ratios in 2021 nonetheless expect to owe rebates this year because those rebates reflect their more profitable experience in the 2020 and 2019 plan years.

The effects of the pandemic continue to be felt, as rebates this year include experience from 2020 and 2021. In 2020, there were several factors‥riving health・a href="https://www.healthsystemtracker.org/chart-collection/how-have-healthcare-utilization-and-spending-changed-so-far-during-the-coronavirus-pandemic/">spending and utilization down. Hospitals and providers cancelled elective care early in the pandemic and during spikes in COVID-19 cases in order to free up hospital capacity, preserve supplies, and mitigate the spread of the virus. Many consumers also chose to forego routine care in 2020 due to social distancing requirements or similar concerns. As insurers had already set their 2020 premiums ahead of the pandemic, many turned out to be over-priced relative to the amount of care their enrollees were using. Some insurers offered premium holidays and many temporarily waived certain out-of-pocket costs, which had a downward effect on their rebates.

The rebates insurers expect to issue later this year will be the first in a while that are based on a 3-year average that does not include 2018. For many individual market insurers, 2018 was a particularly profitable year as they overshot their premiums amid uncertainty about ACA policymaking in 2017, including whether the law would be repealed and replaced, whether cost-sharing payments would be made, or whether the individual market would be enforced by the federal government. The large profits and overhead seen in 2018 are part of why individual market rebates issued in 2019, 2020, and 2021 were so large.

In the small and large group markets, 2021 average loss ratios were 84% and 90%, respectively. (These are simple loss ratios, calculated as the share of premium income paid out as claims, so they do not align perfectly with the ACA MLR thresholds.) Only fully-insured group plans are subject to the ACA MLR rule;・a href="https://www.kff.org/report-section/ehbs-2021-section-10-plan-funding/">about two thirds{f covered workers are in self-funded plans, to which the MLR threshold does not apply.

The rebate amounts in this analysis are still preliminary. Rebates or rebate notices are mailed out by the end of September and the federal government will post a summary of the total amount owed by each issuer in each state later in the year.

Insurers in the individual market may either issue rebates in the form of a check or premium credit. For people with employer coverage, the rebate may be shared between the employer and the employee.、s the cost of employer coverage is often split between the employer and employees, the handling of rebates to employers and employees depends on the way in which the employer and employees share premium costs.

If the amount of the rebate is exceptionally small ($5 for individual rebates and $20 for group rebates), insurers are not required to process the rebate, as it may not warrant the administrative burden required to do so.

After years of relatively flat premiums in the individual market, the higher loss ratios seen in 2021 may foretell steeper premium increases in 2023, as some insurers will aim for lower loss ratios to regain higher margins. Additionally, higher rates of inflation in the rest of the economy may translate to increases in prices demanded by providers, thus driving premiums higher.

Insurers are currently setting premiums for 2023 and have the difficult task of predicting the continued impact of the pandemic, amid further uncertainty about the future of American Rescue Plan Act subsidies in the individual market. Insurers setting premiums for the 2023 plan year will need to factor in several pandemic-related considerations, including but not limited to: potential pent-up demand for care, the negative impact of foregone care on the health of some enrollees, the rate of future COVID-19 hospitalizations, and the need for more booster shots. Additionally, if the federal government runs out of funds to supply vaccine doses, private insurers may need to pick up the costs of vaccines and boosters next year.

If insurers overshoot their premiums amid this uncertainty, they will again be required to issue rebates to enrollees under the Affordable Care Act.

We analyzed insurer-reported financial data from Health Coverage Portal TM, a market database maintained by Mark Farrah Associates, which includes information from the National Association of Insurance Commissioners. The dataset analyzed in this report does not include data from California HMOs regulated by California’s Department of Managed Health Care. All individual market figures in this issue brief are for major medical insurance plans sold both on and off exchange. Medical loss ratios are calculated as the ratio of total incurred claims to health premiums earned.

Total rebates for 2022 are based on preliminary estimates from insurers. Total rebates issued in 2021 differed by about 6% from estimated rebates. In some years, final rebates are higher than expected and in other years, final rebates are lower.